KoinWorks was established in 2016 as a Peer-to-Peer Lending company that aimed to give an opportunity to everyone to achieve their financial goals. KoinWorks has its corporate headquarter in Jakarta with a supporting office in Yogyakarta. Its team consists of very passionate people and strong experts who bring a whole new level of financial experience to the valuable users. Those exceptional qualities are derived from four core values, such as Transforming Life, Delivering Value, Innovate, and Go Above & Beyond.

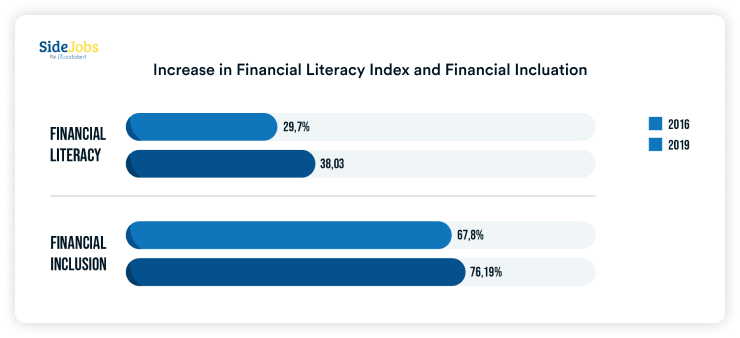

As the financial industry grew exponentially and increasing amount of financial literate people in Indonesia, KoinWorks transformed into the first Indonesia’s giant financial application that offered innovative solutions and eased the access to various financial needs through advanced technology. Through KoinWorks, the company also helped Indonesian government’s mission to provide access to a myriad of quality financial services in a timely, convenient, informed manner, and at affordable cost to the wider community.

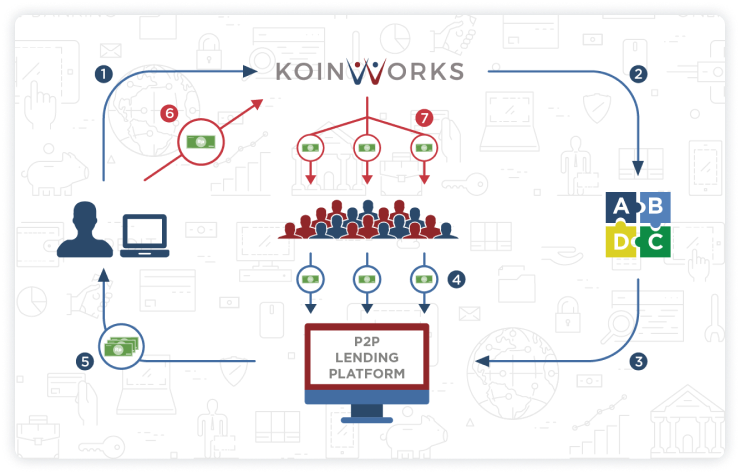

As stated on its name, Peer-to-Peer Lending company is a financial institution that provides platform to lending and borrowing money to individuals or businesses. The main advantage that Peer-to Peer lending companies possesses compare to traditional financial institutions is its effectiveness in cutting costs and speeding up the overall lending process. Borrowers looking for non-bank unsecured online loans with lower loan interest rates will be served by Lenders who are looking for more profitable investment return.

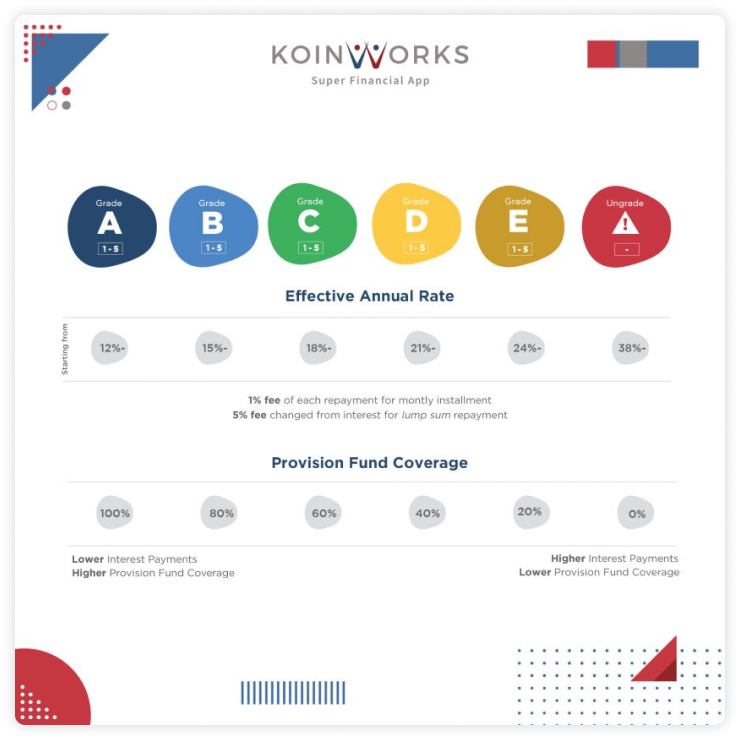

KoinWorks uses a bank-standard loan scoring system in order to create an ecosystem where security of funding at KoinWorks is totally secure. First, those who have passed the credit assessment will be given various credit scores. Loans will be given a score from A to E, which in sequence indicates the level of risk from the lowest to the highest level of risk.

Each score also has 5 levels, from A1 to A5, and so on to the lowest, from E1 to E5. The riskier the loan is, the higher the risk level of default. To compensate for this, riskier loans are subject to higher interest rates. The investment fund starts from IDR 100,000 and effective interest rate starts from 12% annually with 100% protection fund.

In Indonesia, people with higher education, higher income, and male have better knowledge of basic financial literacy. Unfortunately, there is still a few people who meet those criterias. As the result, many people with low basic financial literacy often get caught into fraudulent investments that offer very attractive investment return, but ultimately give no return at all.

Moreover, the rising of unregistered peer-to-peer lending companies in Indonesia that commit investment scam and fraud causes more skepticism and loss of trust among people to invest. This kind of unhealthy environment causes less people want to invest into the legitimate peer-to-peer lending company, thus impact negatively to the industry.

Koinworks as a trustworthy peer-to-peer lending company would like to reach more users to make them register in KoinWorks application, also build awareness of KoinWorks’ apps, platforms and services.

Through SideJobs by NusaTalent, KoinWorks began its user acquisition campaign on NusaTalent application with specific acquired goals. Its goal was to capture new users that have Android and/or iOS smartphones.

The step started from downloading the app until filling all information to become a user. Since, SideJobs by NusaTalent has users who are mostly tech-savvy users (majority of users are university students), therefore such tasks could be performed effectively, as the result, KoinWorks achieved its goals successfully.

More importantly, KoinWorks found that the cost spent to get new users to install is significantly lower than the cost of conventionally acquiring new customers though other advertising channels. This happened because SideJobs by NusaTalent developed ecosystem where its users are willing to find and do freelance jobs. As the result, the campaign became more effective than the traditional one.

Satisfied with the result, the recruiter team enticed to continue the paid plan for 3 months.

By using NusaTalent job platform, we successfully received nearly 3700 candidates within two months.

Successfully held a job fair and created the opportunity for students to meet with a variety of prospective employers.

With SideJobs, the result of a developed product has the potential for monetization.